Annual Report

2024

Evolving Together

President's Letter

Over the past four years, NICB has undergone a transformative journey to modernize our fraud-fighting capabilities, ensuring we meet the evolving needs of our members, law enforcement partners, and strategic allies. I’m proud to share that 2024 marked another milestone in this journey as we united around our mission to combat and prevent insurance crime and fraud with ever-increasing success.

In 2024, we advanced our intelligence capabilities by shifting to a proactive approach—anticipating

challenges rather than simply analyzing past events. We made significant strides in data analytics,

establishing it as a cornerstone of our strategy. By investing in advanced analytics and enhancing

our data infrastructure, we accelerated our ability to identify trends, assess risks, and drive

impactful interventions.

NICB remains focused on looking over the horizon to identify emerging vulnerabilities and equipping

our members and law enforcement partners with forward-looking insights. As the vital link between

the insurance industry and law enforcement, we are committed to delivering actionable intelligence

that strengthens our collective fight against insurance fraud and related crimes.

In close collaboration with federal and state law enforcement, we leveraged these data and

intelligence capabilities in 2024 to investigate and disrupt criminal networks in the United States

and abroad. Our involvement with auto theft task forces and fusion centers led to the recovery of

stolen vehicles for our member companies and their policyholders and the prevention of fraudulent

claims from being paid in the first place.

As part of our commitment to crime prevention, NICB delivered high-quality training in 2024 focused on emerging risks, new fraud schemes, and best practices in combatting insurance crime and fraud. We expanded our Learning and Development offerings, increasing both in the number of courses offered and the range of topics covered, further solidifying our role as the leading resource in this space.

Additionally, NICB remained a strong advocate for our members and partners in 2024, working to

shape federal and state legislation that strengthens our collective fight against insurance fraud

and crime. Given the complexity of the insurance industry and the wide variation in regulations

across states, our Government Affairs team and policy experts play a critical role in educating

elected officials and regulators on the real-world impact of legislative and regulatory decisions.

We continue to drive positive policy changes that empower law enforcement and insurers with the

tools needed to prevent and combat fraud. Energized by our successes in 2024, we are accelerating

these efforts in 2025.

Over the past several years, we have fundamentally changed and transformed our organization

to deliver the capabilities our members depend on with greater speed and efficiency. In 2024, we

brought that evolution to life through a refreshed brand identity—modernizing our logo, colors,

and overall look and feel to better reflect our organization. Our new brand honors our 110-year

legacy while embracing the forward momentum of our organization and the ever-evolving needs

of our members.

David J. Glawe

President and Chief Executive Officer

Operations, Intelligence, & Analytics

Improving Intelligence for Members and Partners

In 2024, Operations, Intelligence, and Analytics (OIA) maintained its strategic focus on improving the relevancy, quality, and timeliness of intelligence products while growing access to unique data sets, standardizing internal business processes, and enhancing data management and automation processes. OIA made significant advancements in its data and workflow processes while enhancing internal efficiency and elevating the quality of external products.

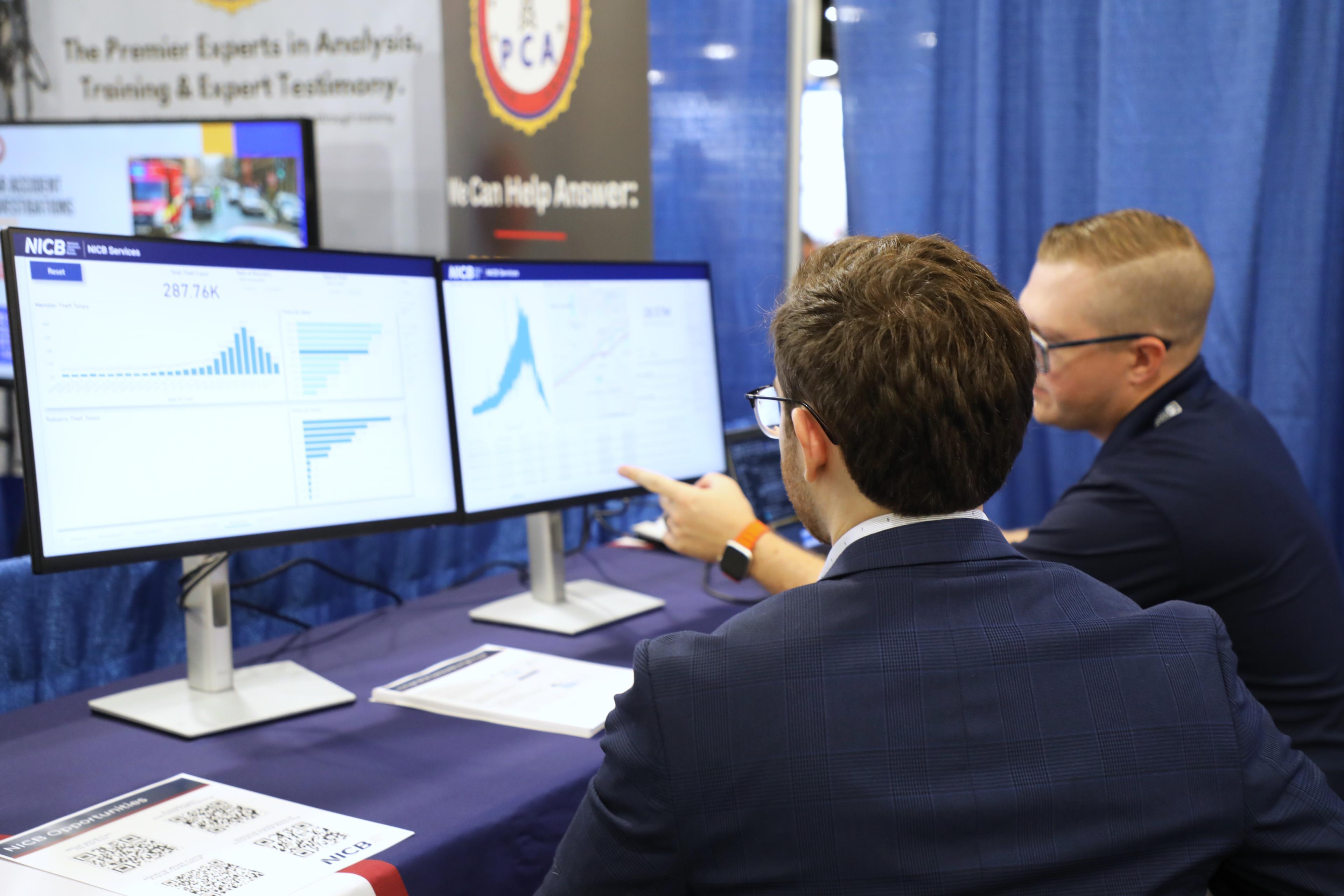

Upgrading Delivery of Data and Metrics

Key initiatives included sweeping upgrades to member-facing dashboards, which improved usability and delivered more precise insights into emerging trends, and the establishment of a new internal metrics system, which enabled real-time visibility for leadership at all levels.

The Data Dashboards:

- Increased member access to data

- Expanded organization awareness of fraud

- Created efficiency gain in metrics tracking

- Improved collaborative efforts with multiple partners

- Advanced efforts to combat insurance fraud and vehicle theft.

Driving Innovation for Members and Partners

The Data Science Team continued to grow and mature throughout the year, building upon previous years’ investments in infrastructure, personnel, understanding the customer base, and strategy

development. Specifically in 2024, the team focused on identifying unique data assets, as well as building solutions and tools. These enhance both our internal investigations and intelligence, as well as support members and strategic partners.

One specific tool included the Salvage Swap Detection project, which generated actionable leads for NICB agents and investigators. Additionally, the team focused on improving internal efficiencies and infrastructure in the program via our cutting-edge entity resolution capabilities and an emphasis on data quality. Operating on a model of testing tools internally first, the team continues to drive towards delivering innovative solutions directly to members and strategic partners.

In 2024, NICB achieved a 61% increase in the production of intelligence report products compared to 2023.

NICB’s proactive approach to addressing member interests was exemplified by products highlighting critical emerging or evolving risks such as travel insurance fraud schemes, peer-to-peer car sharing services, crop insurance fraud, spinal cord stimulator implants, intentional airbag deployment, and metadata manipulation detection strategies. NICB also strengthened relationships with Fusion Centers, which now credit NICB intelligence products in their own law enforcement-sensitive reports. The team also developed intelligence product standards and a style guide to ensure product consistency.

Responding to Disasters

NICB’s Catastrophic (CAT) Response Team was formally activated 12 times in 2024 to support efforts in combatting insurance fraud. The team assisted with the immediate and ongoing analysis and mapping of claims data, monitoring of social media for potential fraud schemes, and working in the field with carriers and emergency management agencies. NICB participated in numerous insurance villages to inform impacted citizens of potential contractor fraud schemes and actively assisted state regulators in monitoring contractor credentials. NICB continues to analyze data, share intelligence, promote community awareness of contractor fraud, and investigate matters involving fraud within impacted regions.

Partnering to Reduce Specialized Fraud

NICB’s Cargo Program conducted and participated in numerous training opportunities and conferences related to the protection of our nation’s supply chains. NICB provided daily assistance to Customs and Border Protection in major ports across the county and participated in a significant search warrant at a regional trucking firm where over 150 various loads of stolen cargo were recovered.

NICB also focused on specialty investigations within the commercial agriculture sector and leveraged enhanced data analytics capabilities to more effectively identify and monitor emerging fraud trends specific to this niche market. The development of a comprehensive training course, tailored fraud indicators, and designation of subject matter experts within NICB bolsters our capability to detect and respond to commercial agriculture fraud.

Integrating Data and Real Investigation Scenarios with Training

OIA provided extensive resources and support to law enforcement and member companies, resulting in 44 targeted operations in medical, vehicle, cargo, contractor fraud, and organized crime cases. Greater emphasis was placed on growing the Contractor Fraud Awareness campaign and the development of a Worker’s Compensation working group. Created in partnership with NICB’s Learning and Development team and external leaders, this group identifies opportunities for collaboration, intelligence exchanges, and training events for external partners. By integrating advanced analytics and real-world case studies into our training programs, NICB empowered investigators with the knowledge and skills necessary to identify and mitigate fraudulent activities more effectively.

NICB participated in a search warrant where over 150 various loads of stolen cargo were recovered.

Maximizing Technology Tools for Information Access

NICB facilitated the recovery of 4,513 vehicles in connection with its License Plate Reader program, and evolved its capabilities by adding new tools, including the Regula System, which uses electromagnetic technology to read altered VINs. NICB agents inspected 7,306 vehicles and now use an NICB-developed Mobile Vehicle Inspection Application to complete vehicle inspections immediately while in the field.

Responding to Requests and Providing Valuable VIN Information

The Investigative Assistance Group (IAG) and the Manufacturers Information Group (MIG) remained critical to the success of vehicle theft and fraud investigations. The IAG addressed over 110,000 requests for information, and the MIG provided 15,000 VIN manuals to members and law enforcement while making VIN manuals available digitally to reduce the cost of printing and increase access.

Accomplishments

Learning & Development

Providing Critical Foundational and Trending Fraud Training for Members and Partners

Learning and Development (L&D) initiatives continue to reinforce our commitment to growth and professional excellence. Recognizing the variety of learning preferences, the L&D team has empowered our members with the knowledge and tools needed to excel through a diverse range of training offerings, including podcasts, microlearning, FraudSmart courses, training academies and on-demand eLearning.

Supporting Members and Partners with Instructor-Led Learning

FraudSmart continued to serve as a cornerstone of NICB’s L&D training offerings, clocking 72 training hours of bi-weekly virtual instructor-led courses on a broad range of insurance fraud topics. Delivered by trained facilitators who are subject matter experts, these sessions offered in-depth insights and real-world applications, fostering engagement through interactive discussions.

In 2024, L&D delivered 70 FraudSmart courses spanning 43 topics to reflect the latest fraud trends and investigative techniques. The FraudSmart program also processed 1,235 continuing education units (CEUs) through state-approved courses developed by NICB to support member compliance requirements and professional development. These current offers demonstrate the program’s role in keeping NICB partners informed and prepared.

For 2024 and beyond, L&D will continue to evolve with impactful training offerings and promote a learning culture which addresses member needs and the fight against insurance crime and fraud.

Academies and Conferences Offer Knowledge and Networking

Alongside traditional FraudSmart instruction, NICB offers additional member training opportunities through academies and conferences. These training options facilitate the transfer of institutional knowledge by providing a structured platform for sharing expertise and experience.

In 2024, two L&D specialized training events drew a collective audience of 299 attendees for the Fraud Investigation Vehicle Crime Academy (FIVCA) and Medical Workers Compensation Fraud Conference (MWCFC). The two events delivered an impactful 37 hours of training and offered in-depth instruction on pertinent vehicle, medical, and workers compensation topics. These events equipped investigative professionals with the latest strategies and best practices and highlight L&D’s dedication to fostering an informed and highly skilled community of professionals.

Bringing Experts Together to Share Experiences

Collaboration and impactful learning opportunities remain central to L&D’s training strategy. Throughout the year, NICB members and the L&D team collaborated on creating and delivering training opportunities tailored specifically to meet the needs of members.

These dedicated training sessions served to deepen partnerships with industry leaders through the delivery of topics including identity theft, vehicle crime and fraud schemes, and medical fraud. These sessions featured creative engagement activities, increasing participation and reinforcing expertise in combating fraud within the insurance industry.

For 2024, over 1500 hours of dedicated training was provided to strengthen industry-wide fraud fighting capabilities and enhance crime prevention efforts.

NICTA Modules Deliver On-demand Critical Fraud Training

The National Insurance Crime Training Academy (NICTA) continued to serve as the premier on-demand eLearning platform to support adjusters and investigators in the insurance fraud fight. In 2024, NICTA expanded training offerings, boasting a comprehensive catalog of over 70 eLearning courses.

NICTA courses are designed to enhance awareness and foster a proactive approach, providing relevant training essential to equip professionals with the skills to detect, prevent, and combat global crime. NICTA courses represent the pinnacle of eLearning and are thoughtfully curated by a team of subject matter experts incorporating professional instructional design elements which provide interactive and impactful training for the adult learner.

To ensure an effective training experience, NICTA introduced multiple new courses related to insurance crime and fraud trends, as well as facilitated upgrades to content and format for existing courses. Furthermore, NICTA processed 16,843 continuing education credits, supporting adjusters and investigators with professional development objectives.

Accomplishments

Strategy, Policy, & Advocacy

Providing a Voice for Members and Partners in the Legislative Arena

In 2024, NICB’s Strategy, Policy, and Government Affairs (SPGA) team continued to be the lead voice on insurance crime and fraud policy in legislatures and other policymaking forums across the country—including at the local, state, and federal levels—advocating on behalf of our members for measures to combat insurance crime and fraud and to strengthen the anti-fraud ecosystem.

A Year of Action

In 2024, SPGA took action on every front on behalf of our members. We submitted 155 letters to lawmakers and committees, testified in-person 18 times, assisted in drafting 41 pieces of legislation, and held an unprecedented 345 meetings with lawmakers, regulators, and their staff - ensuring that NICB’s unique subject matter expertise and the interests of our members remain at the center of key policy debates

occurring throughout the country.

As evidence of our impact, legislatures passed 54 bills to combat insurance fraud and crime, including measures that target predatory towing practices, the assignment of benefits and contractor fraud, and vehicle theft. Moreover, SPGA helped to defeat 33 bills that threatened to undermine the anti-fraud ecosystem, including data-related bills that would have hindered NICB’s role as the connector of the fraud-fighting community.

We submitted 155 letters to lawmakers and committees, testified 18 times, assisted in drafting 41 pieces of legislation, and held an unprecedented 345 meetings with lawmakers, regulators, and their staff.

Bringing Knowledge and Experience to the Industry

Beyond the legislative arena, SPGA strengthened our relationships with key stakeholders in our ecosystem by participating in 64 industry panels or events, holding 107 meetings with members and 272 with industry trade associations, and logging 60 in-person attendances at industry conferences.

We also collaborated with our members, strategic partners, and other key stakeholders to revise and strengthen our organizational policies and procedures, ensuring NICB’s ability to remain nimble, innovative, and always at the forefront of the fight against insurance crime.

Showing Value and Results for Members

Overall, our accomplishments in 2024 demonstrate SPGA’s continued commitment to our highest strategic priorities, further reinforce NICB as the subject matter expert and thought leader within the anti-fraud ecosystem for policymakers and partners, and well-position SPGA for achieving even greater impact for our members in 2025.

Accomplishments

- Spearheaded efforts to pass comprehensive towing reform in several states across the country, partnering with member companies as well as various state and federal trade groups to form broad coalitions of support.

- Partnered with our members and other insurance industry representatives to combat contractor fraud and legal system abuse in Kentucky and Mississippi, helping pass laws to reform assignment of benefits provisions in both states.

- Built upon our record of success in the consumer data privacy arena by securing entity-level exemptions for NICB in states across the country, expanding the total number of data privacy laws enacted with NICB exemptions to 16. Congress also acknowledged NICB’s vital role in combatting crime and fraud by including an NICB-specific exemption in the comprehensive American Privacy Rights Act.

- Significantly contributed to NICB’s annual Contractor Fraud Awareness Week (CFAW) by securing proclamations in 21 states, leading a proclamation signing ceremony, and participating in two CFAW events, including a fraud awareness conference with Kentucky state legislators at which NICB was a featured presenter.

- Convened our seventh annual National Conference of Insurance Crime Attorneys (NCICA), bringing together member in-house counsel and state and local prosecutors to learn best practices, discuss emerging trends, and strengthen our collective hand in assisting the investigation and prosecution of fraudsters.

- Revised and strengthened NICB’s Privacy & Security Policy in collaboration with our members to ensure best practices for data security throughout our partnerships.

Partner Engagement & Member Services

A Focus on Building Partnerships and Adding Value

Throughout 2024 the Partner Engagement and Member Services (PEMS) team focused on growth, innovation, and, most importantly, delivering outstanding customer service to members and strategic partners.

Growing Membership and Aligning with Adjacent Markets to Add Value

Despite working with just two Membership Directors (MD) for most of the year, PEMS onboarded an impressive 22 new Active and Associate members, which is a 20% increase over new members added in 2023. Looking outside the traditional P&C market, 50 percent of these new members were Associate members. Adding those members, their experience and data, brings value and additional perspectives to fighting fraud.

Sharing Information and Challenges in Associate Markets

During 2024, the PEMS team recognized a growing need for information sharing within our Associate members, leading to the creation of new programming in the form of quarterly calls to facilitate discussion across the Vehicle Finance and Rental programs, respectively.

Bringing together professionals from these respective segments of our associate membership with NICB experts and representatives from law enforcement, NICB fostered conversations about the fraud challenges facing these segments and the fraud trends NICB and law enforcement are seeing in the areas. These conversations will help build awareness and identify solutions to help reduce the impact of fraud.

Moving through 2025, NICB plans to increase promotion and participation in these calls to more voices and continue to build potential solutions.

Reaching NICB Members and Partners

A key part of PEMS’ success came from our dedication to building strong relationships with our members. Through sincere and personalized service and active participation in 13 industry events and conferences within and outside of the United States, we retained 99.5% of members who began 2024 with us.

This accomplishment speaks to the trust our members have in us and reflects NICB’s ongoing efforts to meet the evolving needs of our diverse membership.

Adding Value through Strategic Partnerships

Throughout the year, PEMS also focused on enhancing the Strategic Partnership program. Creating an intake form and a review committee helped the team vet interested entities and ensure other NICB departments had awareness of the potential benefit of aligning with the new partner.

In 2024, PEMS tested the intake form on five potential partners which led to one partner going through the review committee and ultimately signing as a Strategic Partner.

Building Relationships and Adding Partners to the Fight

As PEMS enters 2025 with a fully staffed team, NICB remains committed to maintaining a strong community, expanding reach, and providing exceptional service. Reflecting on the 2024 efforts, the PEMS teams stands prepared to confidently tackle what lies ahead pushing boundaries and driving lasting change and impact.

Through sincere and personalized service and active participation in 13 industry events and conferences within and outside of the United States, we retained 99.5% of members who began 2024 with us.

Accomplishments

Public Affairs & Communications

Serving as the Industry's Voice on Insurance Fraud and Crime

NICB’s Public Affairs and Communications team serves as the insurance industry’s national media voice on insurance fraud and crime issues.

For the Public Affairs and Communications Department, 2024 was a year for the history books.

The team refreshed NICB’s branding for the first time in 30 years, spent considerable time and energy on improving the overall member experience—as well as the experience for all key stakeholder groups—and greatly expanded our efforts to support Contractor Fraud Awareness Week, leading to one of the most successful public awareness campaigns in NICB’s history.

Launching the New NICB Brand

In early 2023, NICB kicked off a nearly two-year effort to modernize the organization’s branding, which had not been updated since 1992 when NICB was formed through the merger of the National Automobile Theft Bureau and the Insurance Crime Prevention Institute. This effort aligned with NICB’s broader transformation journey, which began in 2021.

NICB unveiled its new branding—logo, colors, fonts, etc.—to members and the broader insurance industry in early 2024 at the Insurance Fraud Management (IFM) Conference in Houston. At the conference, which NICB co-sponsors, attendees experienced the new brand, which included a new logo on all conference signage and presentation templates, a new booth experience, branded giveaways, and an overall consistent look and feel for NICB.

The team continues to enhance the brand experience to assure all audiences understand the benefits and services NICB offers.

Building Visual Credibility and Name Recognition

Following the unveil, NICB completely revamped every touch point with members, law enforcement agencies, and other strategic partners, including the templates used for member communications, trend reports, insights, video and social media banners, printed banners, etc., as well as every conference booth, tent for community events, and clothing and apparel worn by employees. Plus, NICB launched a rebranded website and updated branding on social media channels.

Additionally, NICB leveraged the new branding in the design of its new headquarters in Oak Brook, Illinois.

While the new brand launched in 2024, the work does not stop. The team continues to identify new opportunities to enhance the brand experience for members, law enforcement agencies, and other partners focusing on message refining to assure all audiences understand the benefits and services NICB offers.

Enhancing Member Experience

As NICB works with members to identify and investigate insurance fraud, Public Affairs and Communications seeks new ways to improve message delivery and overall access to information. From rebranding and promoting access to intelligence products to communicating the key advocacy efforts of our Government Affairs professionals, the team works to identify key channels and opportunities to reach members and provide them with information they need to take advantage of the valuable services NICB provides.

While the focus has traditionally been on the use of email and social media channels to disseminate information, the team is also leveraging partner channels and publications to help advance learning opportunities and key engagement messaging.

In 2025, NICB plans to review and restructure the NICB.org site to focus on member needs while maintaining critical paths for both law enforcement partners and the public. Complimented by targeted communications and newsletters, NICB is committed to helping our members get the information they need when they need it.

Expanding Contractor Fraud Awareness Week Efforts

In 2024, NICB launched one of its most successful public awareness campaigns in the history of the organization with the goal of educating the public on contractor fraud and preventing it from occurring.

Contractor Fraud Awareness Week (CFAW), initially created as a social media campaign by Public Affairs and Communications in 2021, has grown to become an organization-wide initiative involving almost every NICB department and nearly 100 partners in 2024, including member companies, law enforcement partners, state and local governmental agencies, industry trade associations, and other adjacent organizations.

Last year, NICB worked closely with state lawmakers and government leaders in 21 states and Puerto Rico to secure proclamations recognizing CFAW as an official week. This included proclamations in Florida, Georgia, Pennsylvania, and Missouri.

NICB also coordinated in-person events for the first time to support CFAW, partnering with the National Association of Mutual Insurance Companies (NAMIC) and the Kentucky Farm Bureau to host the Kentucky Insurance Fraud Summit. The event was attended by Kentucky state legislators, Kentucky Insurance Commissioner Sharon Clark and her staff, as well as member SIUs and law enforcement partners.

Another event was held in Alabama with nearly two dozen local, state, and federal government agencies and more than 100 members of the public.

Separately, NICB hosted multiple training opportunities related to contractor fraud for members, law enforcement partners, and other key stakeholders. A key training session was a panel discussion of members and industry experts that attracted more than 300 attendees, who provided overwhelmingly positive feedback.

Finally, NICB educated the public on the signs of contractor fraud and how to avoid becoming a victim through a national media tour, which included 21 media interviews that reached more than 60 million people, a targeted social media campaign, and public service announcements in English and Spanish that

aired in cities most prone to large-scale catastrophes and contractor fraud.

Accomplishments

Financial Statements

As a leader in the insurance fraud industry, NICB is honored by the relationships it maintains with their 1,200 active members, associate members, and strategic partners. The challenges that lay ahead demand responsible stewardship of resources and tools, as well as responsiveness, creativity, and diverse talent and viewpoints. As NICB harnesses the power of data and advanced analytics, it will enhance its dedication to fighting insurance fraud and crime.

These financial statements have been prepared by management in conformity with generally accepted accounting principles and include all adjustments which, in the opinion of management, are necessary to reflect a fair presentation. This presentation represents a summarization from audited financial statements.

Statement of Financial Position

Years ended December 31

| ASSETS | 2024 | 2023 |

|---|---|---|

| Current Assets | $14,140,937 | $16,973,991 |

| Investments | 64,394,024 | 58,067,535 |

| Property and use equipment, net | 3,436,664 | 1,717,310 |

| Right-of-use assets, net | 5,351,912 | 5,343,238 |

| Other Assets | 31,180 | 89,063 |

| TOTAL ASSETS | $87,354,717 | $82,191,137 |

| LIABILITIES AND NET ASSETS | 2024 | 2023 |

|---|---|---|

| Current liabilities | $12,395,307 | $11,955,188 |

| Operating lease obligation, net of current portion | 5,517,985 | 4,095,332 |

| Other long-term liabilities | 72,667 | 23,624 |

| Accrued post-retirement obligation, net of current portion | 14,106,000 | 13,433,000 |

| TOTAL LIABILITIES | 32,091,959 | 29,507,144 |

| NET ASSETS WITHOUT DONOR RESTRICTIONS | 55,262,758 | 52,625,417 |

| NET ASSETS WITH DONOR RESTRICTIONS | - | 58,576 |

| TOTAL LIABILITIES AND NET ASSETS | 87,354,717 | 82,191,137 |

Statements of Activities

| REVENUE | 2024 | 2023 |

|---|---|---|

| Assessments and member services | $62,996,799 | $60,597,340 |

| Geospatial member assessment | 716,743 | 5,104,118 |

| Data related and strategic partnership | 1,860,699 | 1,934,722 |

| Miscellaneous income | 465,890 | 636,436 |

| Net assets released from restriction | 58,576 | 23,593 |

| Loss on disposal of property and equipment | - | - |

| Investment return, net for operations | 1,879,201 | 1,640,050 |

| TOTAL REVENUE | $67,977,908 | $69,936,259 |

| EXPENSES | 2024 | 2023 |

|---|---|---|

| Salaries | $39,901,801 | $37,204,949 |

| Employee and retiree benefits | 10,748,766 | 11,019,295 |

| Technical fees and services | 7,275,360 | 6,725,727 |

| Automobile operations | 2,103,805 | 1,891,252 |

| Computer and equipment maintenance | 1,388,350 | 1,160,867 |

| Insurance | 1,198,383 | 1,044,272 |

| Travel and group meetings | 1,132,053 | 1,149,191 |

| Office expense | 721,352 | 1,357,957 |

| Geospatial imagery | 716,743 | 5,104,118 |

| Other | 3,899,464 | 3,484,636 |

| TOTAL EXPENSES | $69,086,077 | $70,142,264 |

| Change in net assets without donor restrictions from operations | ($1,108,169) | ($206,005) |

| Non-operating changes in net assets without donor restrictions | ||

| Loss on disposal of property and equipment | - | (7,159) |

| Investment return, net for operations | (1,879,201) | (1,640,050) |

| Investment return, net | 6,328,711 | 7,507,680 |

| Change in net assets without donor restrictions before post-retirement-related changes other than net periodic post-retirement costs | $3,341,341 | $5,654,466 |

| Post-retirement related changes other than net periodic post-retirement costs |

(704,000) | (1,263,000) |

| TOTAL CHANGE IN NET ASSETS WITHOUT DONOR RESTRICTIONS | 2,637,341 | 4,391,466 |

| Contributions | - | 70,795 |

| Net assets released from restriction | (58,576) | (23,593) |

| Total change in net assets with donor restrictions | (58,576) | 47,202 |

| CHANGE IN ASSETS | 2,578,765 | 4,438,668 |

| Net assets, beginning of year | 52,683,993 | 48,245,325 |

| Net assets, end of year | 55,262,758 | 52,683,993 |

Functional Program Expenses

| PROGRAM SERVICES | 2024 | 2023 |

|---|---|---|

| Investigations | $38,952,410 | $39,228,600 |

| Intelligence and analytics | 13,978,975 | 11,591,699 |

| Learning & Development | 4,793,104 | 4,084,273 |

| Strategy, Policy, and Government Affairs | 2,941,520 | 2,638,326 |

| Communications | 2,254,956 | 2,179,695 |

| Geospatial Intelligence | 938,998 | 5,275,358 |

| TOTAL PROGRAM SERVICES | $63,859,963 | $64,997,951 |

| Administrative and General | 5,226,114 | 5,144,313 |

| TOTAL FUNCTIONAL EXPENSES | $69,086,077 | $70,142,264 |

Note to Financials

Assessment Revenues

The activities of the National Insurance Crime Bureau (“NICB”), conducted principally in the United States, are financed through assessments of its member insurance carriers. Such assessments are determined according to a formula based upon gross premiums for certain lines of business written by member companies and annual verification received from them. During the years ended December 31, 2024 and 2023, nine member organizations made up approximately 54% and 55% of NICB’s assessment and member service revenues, respectively.

Receivables – Assessments and Related

NICB’s accounts receivable consist of assessments, international operations and data-related activities. Accounts receivables are due based on contract terms and stated at amounts due from members net of an allowance for credit losses. Accounts outstanding longer than the contractual payment terms are considered past due. NICB determines its allowance for credit losses by considering a number of factors, including the length of time past due, NICB’s past write-off history, reasonable and supportable forecasts, the member’s

current ability to pay, and the condition of the general economy and industry as a whole. NICB writes off accounts receivable when they become uncollectible, and payments subsequently received on such receivables are credited to the allowance for credit losses.

Net Assets

NICB has net assets with donor restrictions which represent contributions subject to donor-imposed restrictions. These contributions are designated for special operations in support of law enforcement and fraud fighting activities. Net assets without donor restrictions are not subject to donor-imposed stipulations or time restrictions.

Geospatial Intelligence

Geospatial Intelligence was developed to provide the insurance industry and others with comprehensive geospatial imagery “Gray Sky” and analytics related to natural or manmade catastrophic events that members may use to deal with insurance claims and prevent fraud. The program platform delivers catastrophe monitoring and response, comprehensive “Blue Sky” aerial imagery coverage of the United States, and advanced analytics to include pre- and post-damage assessment to its members; leading to more claims decisions, reduction of fraud, and faster catastrophe response.

The scope of the program is dependent on special assessments from its members. Revenue and expenses have reduced from 2023 to 2024. As of Q2 2024, the remaining NICB members participating in the program have been transferred to GIC for program billing. NICB expended $938,998 and $5,275,358 to support the existing program, which includes $222,255 and $171,240 of indirect costs for the years ended December 31, 2024, and 2023, respectively.

Leases

NICB has operating lease agreements for office space and vehicles with lease terms ranging from 1 to 11 years. As permitted within the guidance of ASC 842, NICB has elected to use a risk-free rate for all leases, using a period comparable with that of the lease term.

NICB Post-retirement Plan

NICB provides certain healthcare and life insurance benefits for retired employees. Employees hired prior to April 1, 2004 are eligible to receive this benefit. The NICB Post-retirement Plan is unfunded. As of December 31, 2024, recognition of the net unfunded status of the NICB Post-retirement Plan resulted in current liabilities of $863,000 and non-current liabilities of $14,106,000 for a total benefit obligation of $14,969,000.

Litigation

NICB has been named as a defendant in certain lawsuits wherein the plaintiffs seek to recover damages based upon various allegations arising from certain of these organizations’ investigations. After considering the merits of these actions and the opinions of outside counsel, together with the organizations’ liability insurance coverage, management of NICB believes that the ultimate liability for these matters, if any, will not have a material adverse effect on the NICB financial statements.

Tax Status

NICB has received a favorable determination letter from the Internal Revenue Service dated September 9, 1991, and reaffirmed in 2001, stating that it qualifies as a not-for-profit corporation as described in Section 501(c)(4) of the Internal Revenue Code (IRC) and, as such, is exempt from federal income taxes on related income pursuant to section 501(a) of the IRC. NICB continues to qualify as a not-for-profit corporation under Section 501(c)(4).

Note to Financials

Assessment Revenues

The activities of the National Insurance Crime Bureau (“NICB”), conducted principally in the United States, are financed through assessments of its member insurance carriers. Such assessments are determined according to a formula based upon gross premiums for certain lines of business written by member companies and annual verification received from them. During the years ended December 31, 2024 and 2023, nine member organizations made up approximately 54% and 55% of NICB’s assessment and member service revenues, respectively.

Receivables – Assessments and Related

NICB’s accounts receivable consist of assessments, international operations and data-related activities. Accounts receivables are due based on contract terms and stated at amounts due from members net of an allowance for credit losses. Accounts outstanding longer than the contractual payment terms are considered past due. NICB determines its allowance for credit losses by considering a number of factors, including the length of time past due, NICB’s past write-off history, reasonable and supportable forecasts, the member’s

current ability to pay, and the condition of the general economy and industry as a whole. NICB writes off accounts receivable when they become uncollectible, and payments subsequently received on such receivables are credited to the allowance for credit losses.

Net Assets

NICB has net assets with donor restrictions which represent contributions subject to donor-imposed restrictions. These contributions are designated for special operations in support of law enforcement and fraud fighting activities. Net assets without donor restrictions are not subject to donor-imposed stipulations or time restrictions.

Geospatial Intelligence

Geospatial Intelligence was developed to provide the insurance industry and others with comprehensive geospatial imagery “Gray Sky” and analytics related to natural or manmade catastrophic events that members may use to deal with insurance claims and prevent fraud. The program platform delivers catastrophe monitoring and response, comprehensive “Blue Sky” aerial imagery coverage of the United States, and advanced analytics to include pre- and post-damage assessment to its members; leading to more claims decisions, reduction of fraud, and faster catastrophe response.

The scope of the program is dependent on special assessments from its members. Revenue and expenses have reduced from 2023 to 2024. As of Q2 2024, the remaining NICB members participating in the program have been transferred to GIC for program billing. NICB expended $938,998 and $5,275,358 to support the existing program, which includes $222,255 and $171,240 of indirect costs for the years ended December 31, 2024, and 2023, respectively.

Leases

NICB has operating lease agreements for office space and vehicles with lease terms ranging from 1 to 11 years. As permitted within the guidance of ASC 842, NICB has elected to use a risk-free rate for all leases, using a period comparable with that of the lease term.

NICB Post-retirement Plan

NICB provides certain healthcare and life insurance benefits for retired employees. Employees hired prior to April 1, 2004 are eligible to receive this benefit. The NICB Post-retirement Plan is unfunded. As of December 31, 2024, recognition of the net unfunded status of the NICB Post-retirement Plan resulted in current liabilities of $863,000 and non-current liabilities of $14,106,000 for a total benefit obligation of $14,969,000.

Litigation

NICB has been named as a defendant in certain lawsuits wherein the plaintiffs seek to recover damages based upon various allegations arising from certain of these organizations’ investigations. After considering the merits of these actions and the opinions of outside counsel, together with the organizations’ liability insurance coverage, management of NICB believes that the ultimate liability for these matters, if any, will not have a material adverse effect on the NICB financial statements.

Tax Status

NICB has received a favorable determination letter from the Internal Revenue Service dated September 9, 1991, and reaffirmed in 2001, stating that it qualifies as a not-for-profit corporation as described in Section 501(c)(4) of the Internal Revenue Code (IRC) and, as such, is exempt from federal income taxes on related income pursuant to section 501(a) of the IRC. NICB continues to qualify as a not-for-profit corporation under Section 501(c)(4).

Leadership

Board of Governors, Advisors, & Senior Leadership

Board of Governors

NICB Leadership