Violent Crime and Auto Thefts Continue Record High Trends

Public Needs Heightened Awareness During Holiday Shopping Season

DES PLAINES, Ill., November 23, 2021 — The National Insurance Crime Bureau (NICB) is warning the public of the increased criminal threat environment across the United States this Holiday Season. NICB’s analysis shows significant risk to individual health and safety, straining already-stretched police resources. These threats are expected to continue and potentially intensify during the holidays. Increased vehicular and foot traffic around stores creates more targets for opportunistic criminals.

The nation is witnessing historically high auto theft, violent crime and carjackings. 2020 saw the most vehicle thefts in more than a decade. Beginning in June 2020, the United States experienced a 13% increase in auto thefts, with 41 states seeing an increase over the previous year, a trend that has continued throughout 2021. More alarmingly, many major metropolitan areas saw dramatic increases in carjackings. Unlike auto theft, a carjacking involves violent confrontation with an offender who threatens the victim with bodily injury with a weapon or through physical force. In 2020, Chicago carjackings were up a staggering 134%, with 1,416 people being forcibly removed from their vehicle. This trend has continued in 2021, with Chicago seeing a 44% increase, Washington, D.C. up 45%, and New York an 81% increase.

Due to increased crime risks, NICB encourages shoppers remain alert during the holidays. Criminals are searching for unlocked vehicles to take personal belongings and shopping goods, or to steal the car itself. Most holiday shoppers encounter a number of distractions, from heavy traffic to crowded stores, making auto theft and carjacking more probable. Vehicle owners must be aware of their surroundings and safeguard their vehicles to reduce the possibility of being a victim.

“While people are inside stores spending several hours browsing and waiting in lines, criminals blend into crowded parking lots scanning for vehicles that have belongings or key fobs left inside. Once they find one, if not already unlocked, it takes only five to ten seconds to break a window, grab items and flee the scene without anyone even noticing,” said David Glawe, president and CEO of the National Insurance Crime Bureau. “Even more, some will stakeout desired vehicles, wait for you to return, and under the immediate threat of violence will forcibly take your vehicle. Offenders often prey on those too distracted by their cellphone and surroundings.”

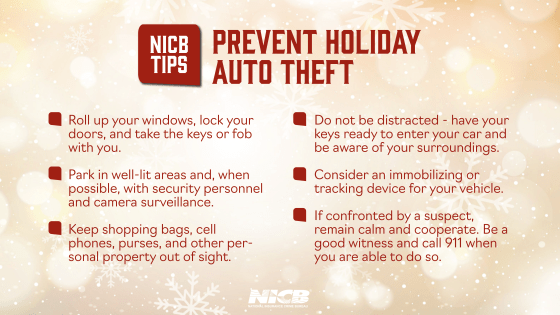

The NICB recommends holiday shoppers take the following simple steps to guard against potential theft and becoming a victim of crime:

- Roll up your windows, lock your doors, and take the keys or fob with you.

- Park in well-lit areas and, when possible, with security personnel and camera surveillance.

- Keep shopping bags, cell phones, purses, and other personal property out of sight.

- Do not be distracted—have your keys ready to enter your car and be aware of your surroundings.

- Consider an immobilizing or tracking device for your vehicle.

- If confronted by a suspect, remain calm and cooperate. Be a good witness and call 911 when you are able to do so.

If your vehicle is stolen, report the theft to the police and contact your insurance company or agent as soon as possible.