America's Hottest Spots for Vehicle Theft

The National Insurance Crime Bureau’s (NICB) 2020 Hot Spots report is here! This report examines vehicle theft data obtained from the National Crime Information Center for each of the nation’s metropolitan statistical areas.

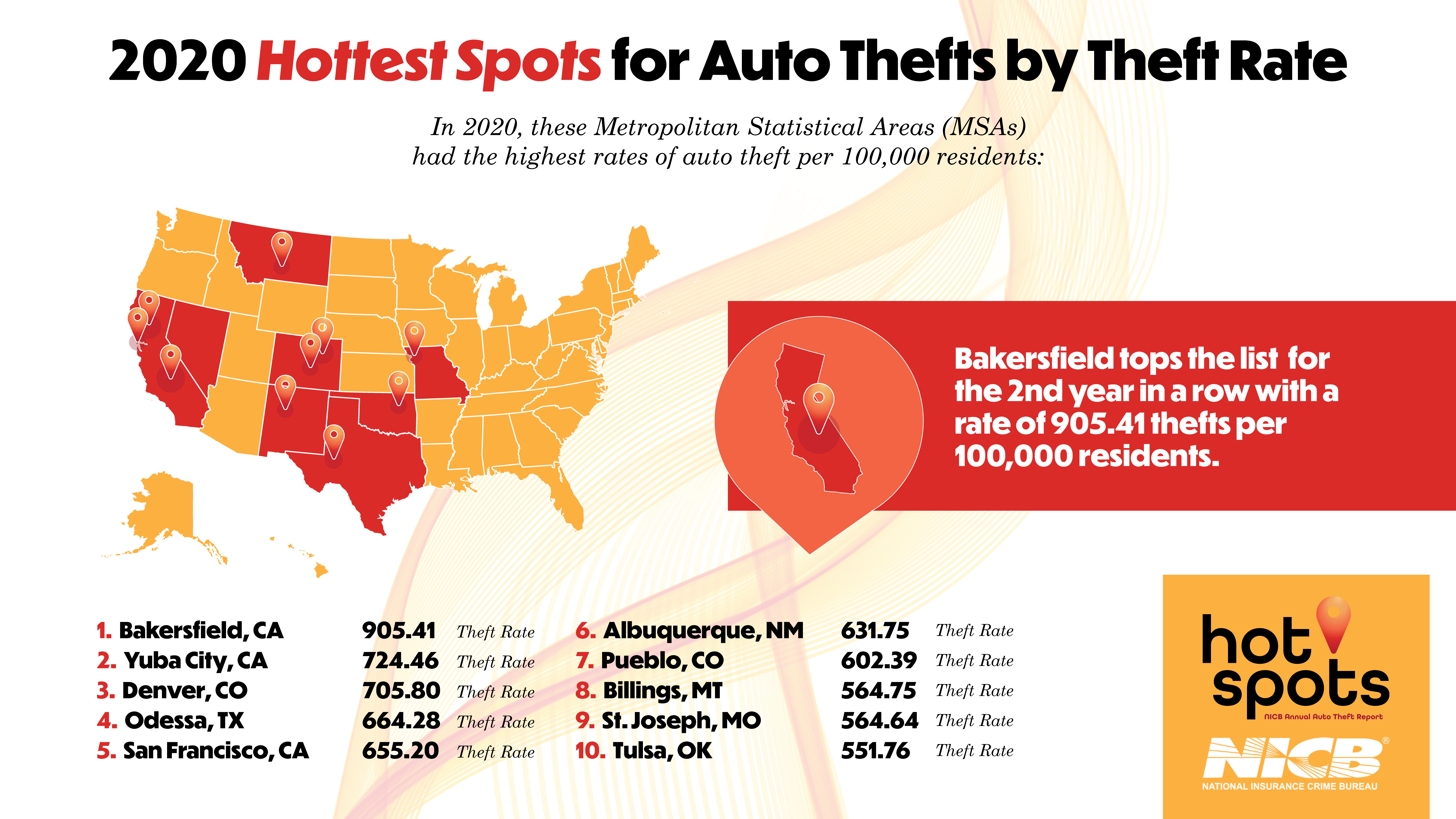

According to the data, auto thefts increased in Colorado by 37%. Additionally, the Bakersfield, CA Metropolitan Statistical Area (MSA) had the highest theft rate in the country for the second consecutive year.

Overall, there were 880,595 vehicle thefts nationwide in 2020, up from 794,019 in 2019. That’s about one stolen vehicle every 36 seconds.

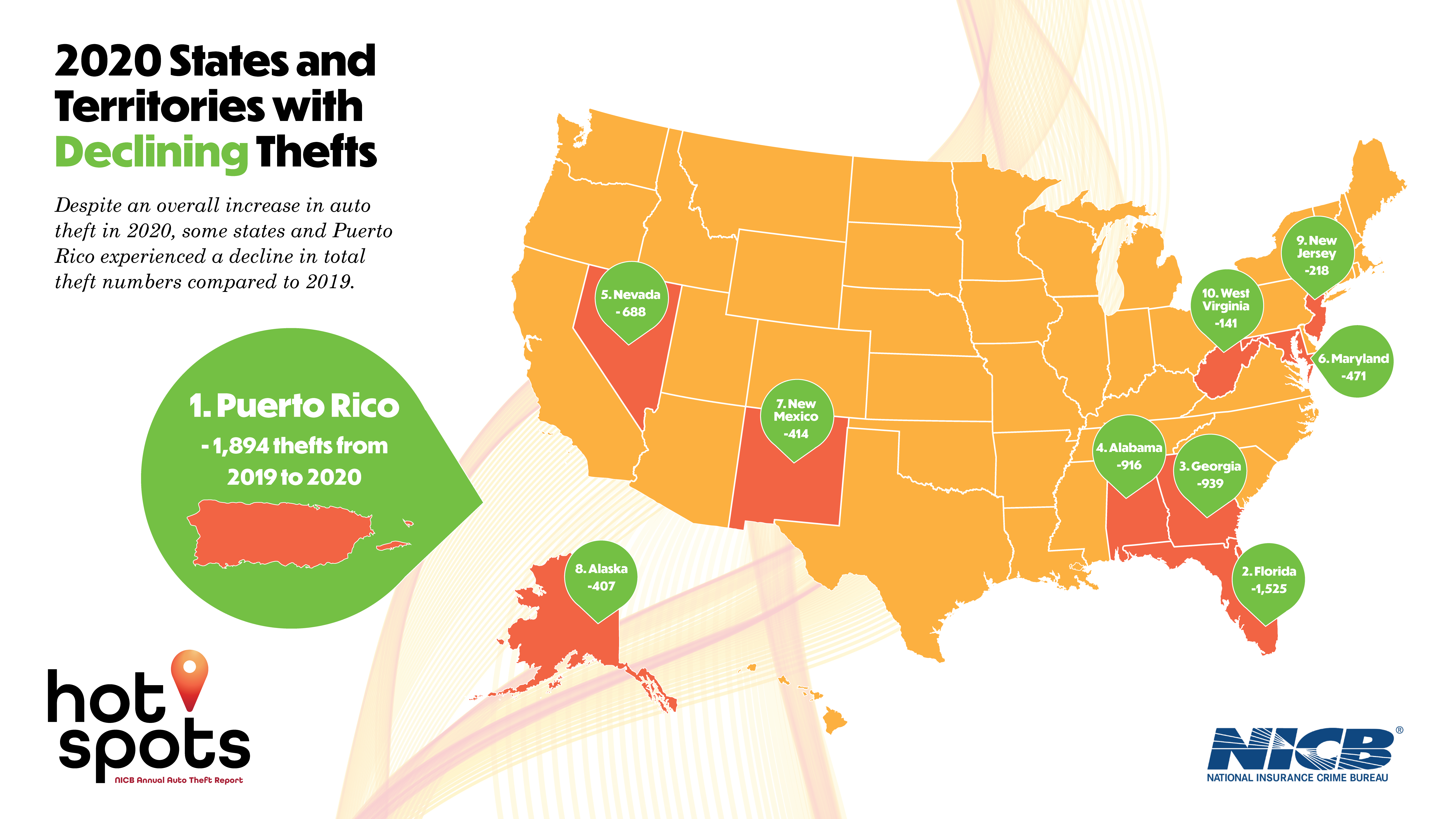

However, there is some good news. Even though thefts in 2020 jumped up significantly nationally, 10 states realized declines in total thefts.

NICB recommends drivers follow four layers of protection to guard against vehicle theft:

Common sense

Vehicle owners should always remove keys from the ignition, lock doors and windows, and park in well-lit areas.

Warning devices

These include visible and audible alarms. Aftermarket alarms are available for all makes and models of cars. Visual devices include column collars, steering wheel locks, and brake locks.

Immobilizing devices

The third layer of protection prevents thieves from bypassing the ignition and hot-wiring the vehicle. Some examples are smart keys; fuse cut-offs; kill switches; starter, ignition, and fuel pump disablers; and wireless ignition authentication.

Tracking devices

Tracking devices are very effective in helping authorities recover stolen vehicles. Some systems combine GPS and wireless technologies to allow remote monitoring of a vehicle. If the vehicle is moved, the system will alert the owner, and the vehicle can be tracked via computer.