Ordinance to Reduce Towing Scams to Be Heard By Chicago Committee

NICB Urges Committee to Pass Proposed Ordinance

DES PLAINES, Ill., May 13, 2021 – Chicago’s Committee on License and Consumer Protection will hear arguments regarding proposed changes to the city ordinance which would require additional licensing to improve towing safety. The National Insurance Crime Bureau supports these changes that will help protect accident victims and stranded motorists from deceitful and potentially dangerous towing company practices.

In part, when renewing or applying for licenses, tow companies must provide proof of a commercial vehicle relocator license, provide a statement certifying the applicant has never been convicted of a felony, and proof of insurance coverage. Once approved, a copy of the license must be placed in plain view within the tow truck and in each office in view of the public. If it is discovered a tow operator falsified or lied on the application the license will be revoked. Additionally, violating accident scene solicitation regulations will become a penalized offense.

“Strengthening licensing provisions and implementing stricter penalties is a step in the right direction to reduce the number of bad actors and improve the safety of innocent drivers,” said Tim Lynch, senior director of government affairs with the National Insurance Crime Bureau. “This has been a long time in coming to better protect accident victims and others simply needing their car towed. We are thrilled to have the Committee vote on these measures.”

Changes to address deceitful towing practices are not unique to Chicago. The city of Philadelphia implemented towing regulations which ultimately safeguarded tow customers and reduced the potential for insurance fraud. California similarly passed regulations prohibiting tow companies from stopping at an accident scene unless called by the vehicle owner or law enforcement and requires all tow companies provide written estimates of all charges to the vehicle operator before proceeding with a tow. Arizona has similar laws and Ohio allows civil action by insurers against a towing company operator to recover a vehicle.

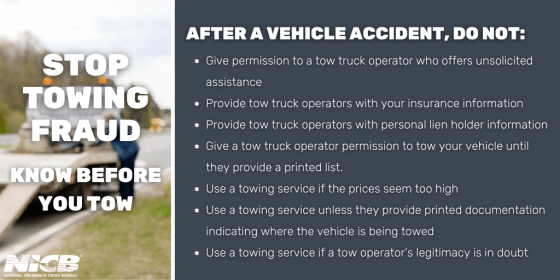

Automobile accidents or breakdowns can put drivers in stressful situations as they must handle issues with missing work or appointments, liability issues or traffic violations. These high-stress situations provide the perfect opportunity for unscrupulous towing companies to take advantage of consumers.

According to data received by members of the National Insurance Crime Bureau, Chicago ranks as the second-worst city in the nation among major cities for towing abuses. Furthermore, a survey of several insurance companies identified Chicago as one of the “most problematic” cities nationally for towing-related abuses.

The Committee on License and Consumer Protection will hear the proposed ordinance amendments during its next meeting May 19th.